Whether you run a "long day care" or not, your hours as a child care service operator are going to be extensive. It’s the same for any small business, because it’s all down to you, and you can’t afford to hire full time accountants and bookkeepers.

Staying on top of your business’ accounts and associated administration is critical if you’re going to enjoy any work-life balance. It’s also important if you’d ever like to expand and might need to get a bank loan. A well-run business is an enjoyable business, so here are six tips to help you stay in control of your finances:

1. Know your current situation

On any day, or at least at the end of every week, you should be able to run a report that tells you if you’re in the red or in the black, and by how much. Your bank account alone won’t tell you the whole story, because you need to know what’s due to come in, and what’s due to go out. If your account looks healthy, but large bills need to be paid before the next round of fees arrive, you could be in trouble.

2. Find out what’s overdue

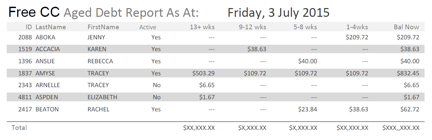

You know what you should be receiving – it’s what you’ve invoiced – but how much of that has actually been paid? It can be a shock to find out how big your "black hole" of unpaid invoices actually is, but you need to know. Accounting and child care management software will enable you to see how much is overdue and by how long, per family. The easiest way to do this is by having an aged debtor’s report.

3. Get familiar with aged debtor’s reports

An aged debtor’s report is very simple. It’s an account of which customers (parents) owe your service money, how much they owe, and when that debt accrued. If you use accounting software, it may be described as "aged receivables". If you have a lot of customers who have been owing you money for more than 4 weeks, as in the below example, it could indicate a problem with late payments.

4. Have an automated invoicing system

Automated invoicing is a great idea for any business. It minimises human error, as depending on your system, you don’t have to fill things out manually each time. It can track whether an invoice has been received and/or read, and issue reminder notices for you, as well as overdue alerts. This lifts a lot of administration from your shoulders, as well as the stress of having to chase parents for payments.

5. Have a clear payments plan

When setting up your invoicing, whether you do it manually or automated through software, set up a clear schedule and stick to it. Here are some suggested guidelines:

- You might decide to invoice every week

- Bills not paid within two weeks could be noted with no action required just yet

- At three or four weeks, a gentle reminder should be sent

- At four weeks or more (30 days is often the default), depending on what payment terms you set, sterner messaging might be appropriate as bills fall overdue

6. Adjust and evolve your plan

If you have parents that are continual late payers or non-payers, you will have to consider some kind of action. But long before legal action or even excluding a child becomes necessary, you may be able to tighten your payment terms to encourage them to pay, for example:

- Invoice them earlier, more frequently

- Incentivise early payments by offering a discount

- Some parents may find it easier to pay smaller, more regular amounts

- Late payment penalties: Nearly every child care service imposes late pick-up fees, so why not impose late payment ones as well?

Child care is a very personal, one-to-one business. It’s difficult to greet parents each morning, in a friendly way, and then have to send them final demands later that day. Psychologically, it’s "easier" if a machine is automating these types of tasks for you. Putting a system in place to assist you in collecting payments will provide you a bird’s eye view of your current financial situation and equally as important, will help to take some of the stress away.

To gain more insight into ways you can encourage your parents to pay their fees on time and avoid bad debts, download our free guide ‘Child care services: Getting smart with fee payments’ by clicking on the button below.